"Going Under": Winding Up a Company

- Bryan Wang

- May 17, 2020

- 6 min read

Updated: May 31, 2020

Previously, we discussed the various ways a company might avoid falling into insolvency. However, corporate collapses are becoming increasingly likely affair given that the recommencement of most business operations is now further delayed as a result of the recent extension of the Movement Control Order until the 12th of May, 2020.

In this article, we discuss the legal process of shutting down a company. This process is called ‘winding up’ and in Malaysia, there are several ways to wind up a company:

Voluntary winding up by the company’s members (for solvent companies);

Voluntary winding up by the company’s creditors (for insolvent companies);

Compulsory winding up by the Court (regardless of solvency).

(i) Voluntary Winding Up by the Company’s Members

This method of winding up a company is initiated by the members of the company itself. The process is commenced by preparing and lodging a Declaration of Solvency with the Registrar of Companies. The declaration takes the form of a statutory declaration signed and prepared the board of directors, stating their collective opinion that the company will be able to fully satisfy all its debts within 12 months.

The board then nominates a liquidator to distribute corporate assets upon the winding up of the company, and gives notice to all its members to convene a members’ meeting that will take place no less than 21 days after the date on which notice was given.

During the meeting, the company tables a special resolution (requiring at least 75% approval from all members) to wind up the company and to appoint the nominee liquidator. Soon after the meeting, must then:

lodging a copy of the special resolution with the Registrar of Companies and advertising the resolution in a local newspaper; and

lodging the notice of appointment and address of the appointed liquidator with the Registrar of Companies and the Official Receiver’s office.

In the rare situation that members wish to wind up a company that has ‘out lived’ it’s constitutionally prescribed expiry date in accordance with the terms its constitution/ articles of association, the method to commence the winding up process should be by way of an ordinary resolution (requiring at least 51% of members’ approval), instead of a special resolution.

An advantage of winding up a company through this process is for tax efficiency reasons. Unlike the distribution of dividends to shareholders, the distributions received by shareholders through liquidation in a winding up scenario is unlikely to be considered as taxable income.

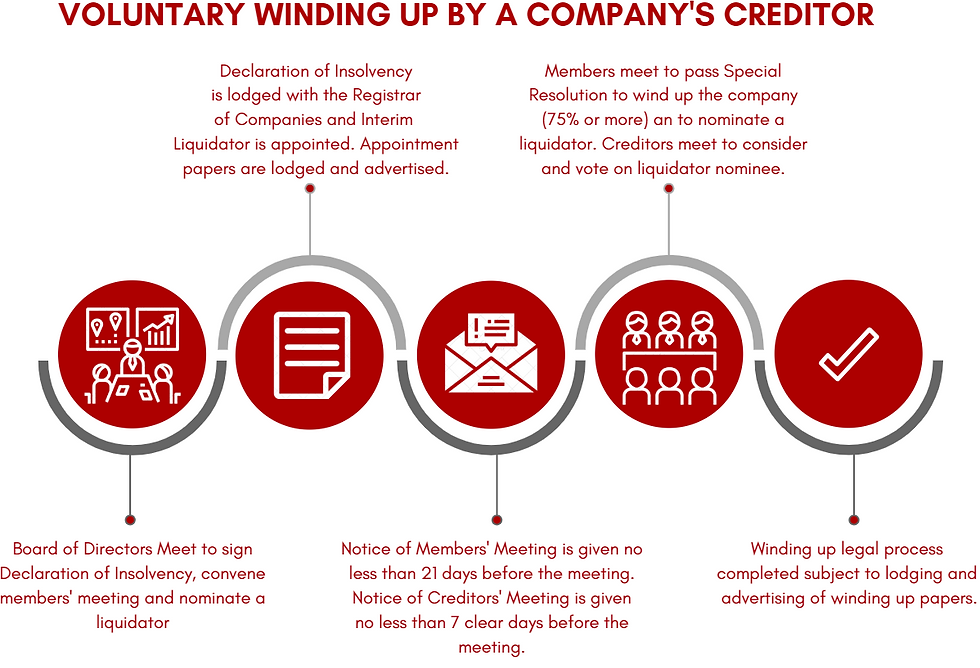

(ii) Voluntary Winding Up by the Company’s Creditors

Unlike the method outlined above, this form of winding up is reserved for insolvent companies and is initiated by the company’s members and/or directors. The key difference with a members’ winding up is that the creditors make the final decision on who will carry out the function of the liquidator.

It is commenced by preparing a signed Declaration of Insolvency by the company’s board and lodging the same with the Registrar of Companies and the Official Receiver’s office. The declaration also takes the form of a statutory declaration, collectively stating the board’s opinion that the company is no longer able to continue its business.

The board then appoints an interim liquidator and convenes both a members’ meeting and a creditors’ meeting are convened. Unlike the situation in a member’s winding up, a liquidator is immediately appointed right after lodging the declaration for a duration of 30 days. The notice of appointment must be lodged with the Registrar of Companies and the appointment must be advertised in a local newspaper.

This interim liquidator will only be officially appointed at the creditors’ meeting, but will still be able to assess the financial health of the company, take stock of what areas are of greater concern and warrant further investigation, as well as to make the necessary preparations ahead of the winding up process.

Notice must also be given for the convening of both meetings – 21 days’ notice for the members’ meeting and 7 clear days (i.e. excluding the day on which notice is given and the day on which the meeting takes place) for the creditors’ meeting.

At the members’ meeting, a special resolution must be tabled to wind the company up and to nominate a liquidator, which may either be the interim liquidator or an entirely different nominee liquidator. The creditors make the final call on the liquidator’s appointment at the creditors’ meeting. At this meeting, creditors’ are also entitled to establish a Committee of Inspection designed to safeguard the interests the company’s creditors and to assist the liquidator in discharging their functions.

Soon after these meetings, the company is required to:

advertise the special resolution in a national newspaper and lodge the same with the Registrar of Companies; and

lodge the notice of appointment and address of the liquidator with the Registrar of Companies and Official Receiver’s office.

(iii) Compulsory Winding Up by the Court

Under this method of winding up, the Court takes control over the winding up process away from the directors and members’ of the company. Typically, this is commenced by way of a petition lodged by a creditor in relation to an unpaid debt. However, ‘prospective’ creditors may also petition for the company to be wound up i.e. a creditor who is owed a sum not immediately payable but will become due on a fixed date in the future. There are numerous grounds/reasons for a company to be compulsorily wound up by the Court. The leading ones are:

the company is unable to pay its debts;

shareholders have passed a special resolution to wind up the company;

the company no longer appears to be carrying on its business;

the board of directors have unfairly managed the company and have acted in their own personal interests;

the company is being used as a vehicle for unlawful or illegal activity; and

the Court thinks that it is just and equitable to wind up the company.

As previously mentioned, the company’s inability to pay its debts is a commonly cited ground for winding up. To commence compulsory winding up proceedings against a company for an unpaid debt, a creditor would first need to issue a letter of demand to the company to settle a debt of at least RM10,000.00 or more within 21 days.

Take note, however, that the minimum debt demanded for has been temporarily increased from RM10,000.00 to RM50,000.00 and the time limit to reply to a letter of demand has been temporarily increased from 21 days to 6 months due to the Movement Control Order and the COVID-19 pandemic. These measures will only remain in effect until the 31st of December 2020, after which the original thresholds come back into force.

Should the company fail settle the amount owed after 21 days (or 6 months), the law then presumes that the company is insolvent i.e. is unable to pay its debts as and when they become due a creditor may file a winding up petition with the Court. Upon the presentation of the winding up petition, any transaction/disposition of company property will be considered void and may be reversed by the Court.

The creditor then needs to then give notice of the petition to all creditors of the company by publishing the petition in the Government Gazette and advertising the same in a local newspaper. The court then sets a hearing date to decide whether or not the company should be wound up. Aside from disputing the petition at the hearing, the company may also choose to mitigate the potential reputational harm caused by the newspaper advertisements and gazette publications of the winding up petition by applying to the Court for an injunction to prevent the petition from being presented, otherwise known in legalese as a ‘Fortuna injunction’.

(iv) The End Result

If and when a Court grants an order to wind up a company, the board of directors will be stripped of their powers and the liquidator assume managerial control over the company. Fresh legal actions may not be commenced against the company without the Court’s permission. Finally, the company has to shut down its business operations unless the appointed liquidator is of the opinion that continuing operations would be beneficial towards the winding up process, but no longer than 180 days in any event.

At the end of the winding up process, the liquidator would have distributed all of the company’s assets and settled its affairs. The liquidator would then proceed to dissolve the company. In the case of voluntary winding up, the liquidator prepares a final report outlining the winding up process and lodges a final returns and account with the Registrar of Companies and the Official Receiver. With regards to compulsory winding up cases, the liquidator only needs to make an application to the Court to be released from his duties and for the company to be dissolved.

Comments